Electric company car tax explained

April 2020 was a watershed moment for electric vehicles (EVs) as company cars. The UK government slashed electric company car tax, instantly making EVs much more attractive for businesses and employees. Here we take a look at what company car tax is, what’s changed, and how it compares between different types of cars.

What is company car tax?

Getting a company car is a real perk for employees. It’s often pretty exciting too. That can be tempered when you get lumped with a company car tax bill, however.

Tax is due as soon as a company car is used privately, which includes commuting to work. This is because it becomes known as a benefit in kind (BIK), with the good folk at HMRC deciding how much is owed based on several different things.

How much is company car tax?

The level of company car tax you pay depends on the value of the vehicle and your earnings. It’s also affected by things like whether you have the vehicle full-time and if you pay anything towards the cost of purchase. The amount of company car tax due is also based on what type of fuel the vehicle uses and its CO2 emissions.

Put simply, if you’re on a big wage and you drive an expensive car with high emissions, you’re going to pay the most in company car tax. You can use the government’s calculator tool to work out exactly how much you owe. The amount of tax due can be very high, easily running into thousands of pounds per year – unless you have an electric car, that is.

What is electric company car tax?

The company car tax on electric cars was eliminated (0%) for the 2020/21 financial year. That’s right; there was zero, zilch, zip all to pay.

The government decided to cut the rate from 16% to 0%. Given company car tax is often hundreds of pounds a month, or even more, this means there are huge savings when you go electric.

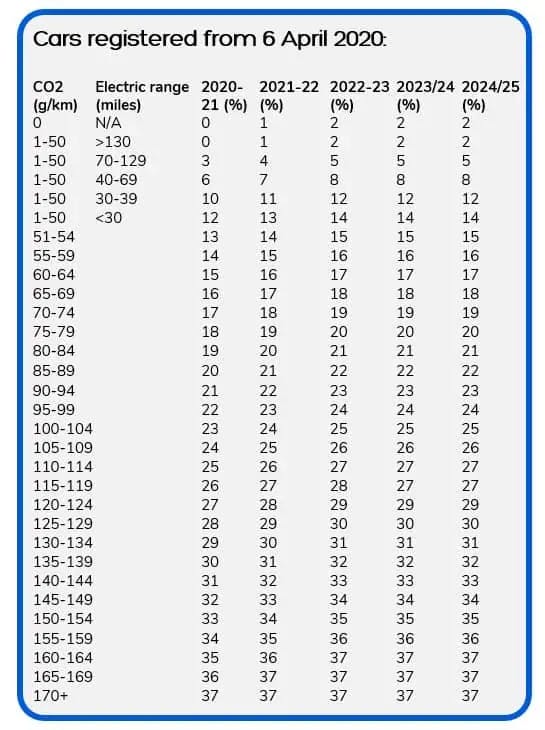

What are EV benefit-in-kind rates now and in the future?

This year 2024/25, the electric vehicle company car tax rate stands at just 2% of an EV’s taxable list price. This is also known as the P11D value.

The following year this remains at 2%, keeping the level far below petrol and diesel vehicles, as well as plug-in hybrids. These other vehicles come within a new set of bands rising to a maximum of 37%, depending on emissions. Some diesel vehicles also attract an extra 4% supplement.

While the 2% rate for electric vehicles will remain up to April 2025, do not fret, as in November 2022 the UK Government announced plans to apply small incremental increases on EV company car tax, given renewed certainty and a longer term commitment of going pure electric.

- 2025/2026 = 3% BIK

- 2026/2027 = 4% BIK

- 2027/2028 = 5% BIK

To give these figures some context, although the rate is rising it still places electric cars significantly under rates of petrol, diesel and hybrid vehicles.

For example, an efficient petrol or diesel car which emits around 100g/km of CO2 is likely to have a BIK rate of 25% - still 5x the BIK level of an EV in 2027/28.

These benefit-in-kind rates make electric car super-affordable compared to petrol and diesel models. Reducing tailpipe emissions and reducing costs.

It's also a reason why EV salary sacrifice schemes are a great way to empower employees to go electric - just like our scheme.

Example BIK comparison

Let's compare an EV and a fuel efficient 100g/km CO2 petrol car. Even though EV BIK will increase, the graph shows that even compared to an efficient petrol powered car the savings are substantial and clear.

2023 - 2028

Petrol company car (100g/km of CO2)

2024/2025

Electric company car

2027/28

Electric company car

Company car tax by fuel type

Let's compare two similar-sized models both from Volkswagen and see how the tax stacks up. Here's the tail of the tape... Volkswagen ID.3 vs Volkswagen Golf. Only one can win.

Benefit in Kind (BIK) |

Monthly tax @ Income Tax rate of 20% |

Monthly tax @ Income Tax rate of 40% |

Monthly tax @ Income Tax rate of 45% |

|

|---|---|---|---|---|

Volkswagen id.3 150kW Life Pro Perform 58kWh 5dr Auto | P11D £36,935.00 |

||||

2024/2025 |

£738.70 |

£12.30 |

£24.62 |

£27.70 |

Volkswagen Golf 8 Style 1.5 eTSI 130PS 7-speed DSG 5 Door | P11D £30,795 |

||||

2024/2025 |

£9,238.50 |

£153.98 |

£307.95 |

£346.44 |

As you can see, EVs offer enormous savings on company car tax compared to petrol and diesel models.

In the example above, a 20% income tax payer would save in 12 months over £1,500 in tax and a 40% income tax payer would save over £3,000 in tax.

Benefits of having an electric company car

As well as the environmental and reputational benefits enjoyed by both businesses and employees from running EVs, there are plenty of advantages when it comes to costs too. These include:

Data updated: April 2023

- Company Car Tax Rate

-

2%

FY2024/2025

- Future Company Car Tax Rate

-

2% rising to 5%

2025 to 2028

- London Congestion Charge

-

100%

Discount (after registering)

- Expenses

-

9p per mile

Driving on business

Are electric cars good as company cars?

Electric cars aren’t just good as company cars – they’re great!

Whether you’re more concerned about reducing your carbon footprint or cutting costs, the UK’s ever-expanding public charging network means it’s easy to keep your battery topped up even if you cover a lot of miles each day.

If you're looking for an electric car lease, there's a huge amount of choice out there - whether you're in the market for a nippy city car or a luxurious motorway loving executive saloon, there's an electric car for you.

From the best green company cars to the essential steps of how to lease an EV, we’re here to help and guide you on our collective journey towards a cleaner, greener future.

Give us a call today on 01628 899 727 to discuss your business electric car leasing options – our friendly team will be more than happy to answer your questions.

Our electric car lease offers...

BYD Dolphin 150kW Design 60.4kWh 5dr Auto

- £2,086.55 Initial rental (ex. VAT)

- £2,503.86 Initial rental (inc. VAT)

- 24 Month term

- 5000 Annual mileage

- Subject to status and conditions + arrangement fee

Skoda Enyaq iV 210kW 85x Sportline Plus 82kWh 4x4 5dr Auto

- £3,218.22 Initial rental (ex. VAT)

- £3,861.86 Initial rental (inc. VAT)

- 36 Month term

- 5000 Annual mileage

- Subject to status and conditions + arrangement fee

Kia Niro EV 150kW 2 Nav 64kWh 5dr Auto

- £2,696.79 Initial rental (ex. VAT)

- £3,236.14 Initial rental (inc. VAT)

- 48 Month term

- 5000 Annual mileage

- Subject to status and conditions + arrangement fee

More EV guides

Can electric car batteries be charged with solar panels?

Guide: Is nuclear power considered renewable?

An intro into decarbonising the National Grid